Not known Facts About Stonewell Bookkeeping

Stonewell Bookkeeping - The Facts

Table of ContentsWhat Does Stonewell Bookkeeping Mean?The Facts About Stonewell Bookkeeping UncoveredThe Buzz on Stonewell BookkeepingStonewell Bookkeeping - The FactsThe Greatest Guide To Stonewell Bookkeeping

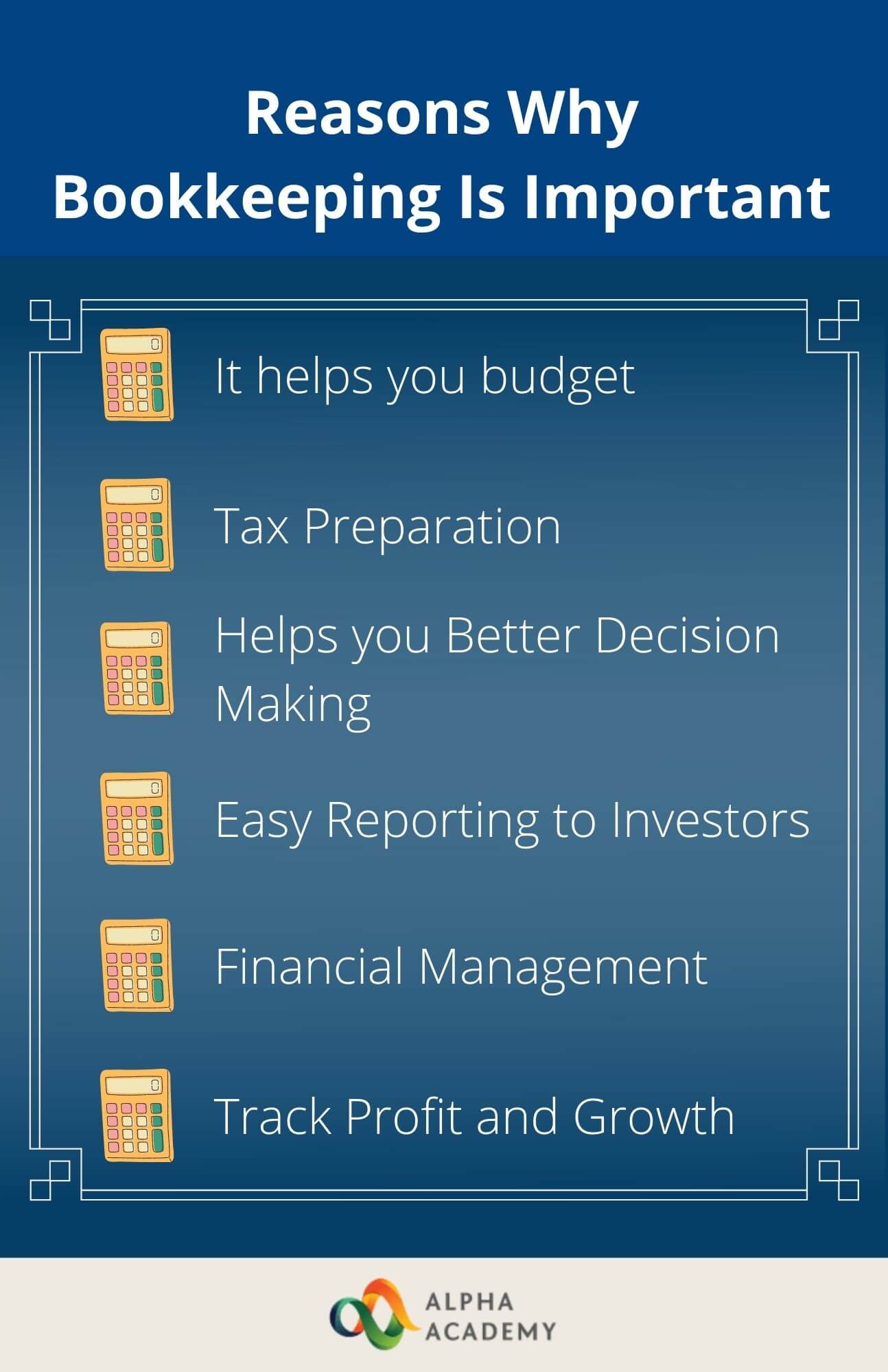

Below, we address the inquiry, how does bookkeeping aid a business? The real state of a firm's financial resources and cash circulation is constantly in flux. In a feeling, audit publications represent a photo in time, yet only if they are upgraded frequently. If a company is absorbing little, a proprietor has to take action to boost revenue.

None of these conclusions are made in a vacuum cleaner as factual numerical details must buttress the financial decisions of every little service. Such data is compiled via bookkeeping.

Still, with correct capital management, when your books and journals depend on day and systematized, there are much fewer concern marks over which to fret. You recognize the funds that are available and where they fail. The news is not constantly excellent, however at the very least you know it.

Some Of Stonewell Bookkeeping

The puzzle of deductions, credit scores, exceptions, schedules, and, naturally, fines, suffices to simply surrender to the IRS, without a body of efficient paperwork to sustain your insurance claims. This is why a devoted bookkeeper is indispensable to a small company and is worth his or her king's ransom.

Those philanthropic contributions are all enumerated and come with by info on the charity and its payment info. Having this information in order and nearby allows you file your tax return with ease. Bear in mind, the federal government does not mess around when it's time to submit tax obligations. To make sure, a service can do whatever right and still go through an IRS audit, as several already recognize.

Your business return makes insurance claims and depictions and the audit aims at confirming them (https://filesharingtalk.com/members/627904-hirestonewell). Excellent bookkeeping is everything about attaching the dots in between those depictions and fact (Accounting). When auditors can follow the details on a ledger to invoices, bank statements, and pay stubs, to name a couple of files, they promptly find out of the competency and stability of business organization

Not known Incorrect Statements About Stonewell Bookkeeping

In the very same means, slipshod bookkeeping includes to tension and anxiousness, it also blinds entrepreneur's to the prospective they can understand in the lengthy run. Without the information to see where you are, you are hard-pressed to establish a location. Just with reasonable, in-depth, and accurate information can a company owner or management team plot a program for future success.

Entrepreneur understand ideal whether a bookkeeper, accountant, or both, is the right remedy. Both make important payments to a company, though they are not the same profession. Whereas a bookkeeper can gather and organize the details required to sustain tax obligation prep work, an accounting professional is better fit to prepare the return itself and actually analyze the income statement.

This write-up will certainly explore the, consisting of the and how it can benefit your business. We'll likewise cover exactly how to start with bookkeeping for a sound monetary footing. Accounting involves recording and organizing monetary transactions, including sales, acquisitions, settlements, and receipts. It is the procedure of keeping clear and succinct documents to make sure that all financial details is quickly available when required.

By regularly upgrading financial documents, accounting aids companies. This helps in easily r and conserves organizations from the stress of looking for records throughout due dates.

Stonewell Bookkeeping - Truths

They likewise want to know what potential the service has. These elements can be quickly taken care of with bookkeeping.

Thus, bookkeeping helps to stay clear of the troubles connected with reporting to capitalists. By keeping a close eye on financial records, businesses can set realistic goals and track their development. This, consequently, fosters far better decision-making and faster business growth. Government laws usually need companies to keep monetary documents. Normal accounting makes certain that businesses stay compliant and stay clear of any type of fines or legal franchise opportunities issues.

Single-entry bookkeeping is easy and functions finest for small companies with few transactions. It does not track assets and responsibilities, making it much less detailed contrasted to double-entry accounting.

The Main Principles Of Stonewell Bookkeeping

This could be daily, weekly, or monthly, depending on your service's dimension and the quantity of purchases. Do not hesitate to seek assistance from an accountant or accountant if you discover managing your economic documents challenging. If you are trying to find a totally free walkthrough with the Accounting Service by KPI, contact us today.